Complete NCERT Solutions Guide

Access step-by-step solutions for all NCERT textbook questions

Welcome to the Chapter 5 - Accounting Ratios, Class 12 Accountancy - Company Accounts and Analysis of Financial Statements NCERT Solutions page. Here, we provide detailed question answers for Chapter 5 - Accounting Ratios. The page is designed to help students gain a thorough understanding of the concepts related to natural resources, their classification, and sustainable development.

Our solutions explain each answer in a simple and comprehensive way, making it easier for students to grasp key topics Accounting Ratios and excel in their exams. By going through these Accounting Ratios question answers, you can strengthen your foundation and improve your performance in Class 12 Accountancy - Company Accounts and Analysis of Financial Statements. Whether you’re revising or preparing for tests, this chapter-wise guide will serve as an invaluable resource.

Ratio analysis is a quantitative procedure of obtaining a look into a firm’s functional efficiency, liquidity, revenues, and profitability by analysing its financial records and statements. Ratio analysis is a very important factor that will help in doing an analysis of the fundamentals of equity.

The various kinds of financial ratios available may be broadly grouped into the following six silos, based on the sets of data they provide:

1)Liquidity Ratios.

2)Solvency Ratios.

3)Profitability Ratios.

4)Efficiency Ratios.

5)Coverage Ratios.

6)Market Prospect Ratios.

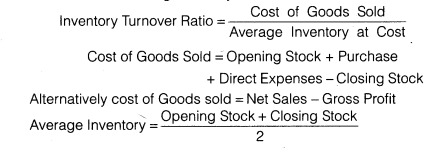

(a) Inventory Turnover Ratio: This ratio is a relationship between the cost of goods sold during a particular period of time and the cost of average inventory during a particular period. It is expressed in number of times. Stock turnover ratio/inventory turnover ratio indicates the number of time the stock has been turned over during the period and evaluates the efficiency with which a firm is able to manage its inventory. This ratio indicates whether investment in stock is within proper limit or not. The ratio is calculated by dividing the cost of goods sold by the amount of average stock at cost. The formula for calculating inventory turnover ratio is as follows

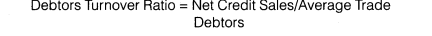

(b)Debtor Turnover Ratio :Debtor turnover ratio or accounts receivable turnover ratio indicates the velocity of debt collection of a firm. In simple words it indicates the number of times average debtors (receivable) are turned over during a year. The formula for calculating Debtors turnover ratio is as follows

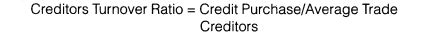

(c)Creditors/Payables Turnover Ratio :It compares creditors with the total credit purchases. It signifies the credit period enjoyed by the firm in paying creditors. Accounts payable include both sundry creditors and bills payable. Same as debtor’s turnover ratio, creditor’s turnover ratio can be calculated in two forms, creditors’ turnover ratio and average payment period. The following formula is used to calculate the creditors Turnover Ratio

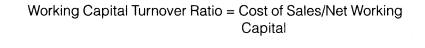

(d)Working Capital Turnover Ratio Working capital turnover ratio indicates the velocity of the utilization of net working capital. This ratio represents the number of times the working capital is turned over in a year and is calculated as follows

Yes it is true that the liquidity of a business firm is measured by its ability to pay its long term obligations as they become due. Here the long term obligation means payments of principal amount on the due date and payments of interests on the regular basis. For measuring the long term solvency of any business we calculate the following ratios.

Debt Equity Ratio: Debt equity ratio indicates the relationship between the

external equities or outsiders funds and the internal equities or shareholders

funds. It is also known as external internal equity ratio. It is determined to ascertain soundness of the long term financial policies of the company. Following formula is used to calculate debt to equity ratio.

Debt Equity Ratio = External Equities.

Shareholders funds

Proprietory Ratio/Total Assets to Debt Ratio: Total assets to Debt Ratio or

Proprietory Ratio are a variant of the debt equity ratio. It is also known as equity

ratio or net worth to total assets ratio. This ratio relates the shareholder’s funds

to total assets. Proprietory / Equity ratio indicates the long-term or future

solvency position of the business. Formula of

Proprietory or Equity Ratio = Shareholders funds

Total Assets

Proprietory/Equity Ratio Interest Coverage Ratio: This ratio deals only with

servicing of return on loan as interest. This ratio depicts the relationship between

amount of profit utilise for paying interest and amount of interest payable. A high

Interest Coverage Ratio implies that the company can easily meet all its interest

obligations out of its profit.

Interest Coverage Ratio = Net Profit before interest and tax

Interest on Long Term loans

Inventory Turnover Ratio: This ratio is a relationship between the cost of goods sold during a particular period of time and the cost of average inventory during a particular period. It is expressed in number of times. Stock turnover ratio/inventory turnover ratio indicates the number of time the stock has been turned over during the period and evaluates the efficiency with which a firm isable to manage its inventory. The formula for calculating inventory turnover ratio is as follows:

Inventory Turnover Ratio = Cost of goods sold

Average Inventory at Cost

Cost of goods sold = Opening Stock + Purchase + Direct Expenses - Closing Stock

Alternatively cost of goods sold = Net Sales - Gross Profit

Average Inventory = Opening Stock + Closing Stock

2

From the above formula, it is clear that this ratio reveals the average length of

time for which the inventory is held by the firm.

Liquidity ratios are calculated to determine the short-term solvency of a business, i.e. the ability of the business to pay back its current dues. Liquidity means easy conversion of assets into cash without any significant loss and delay. Short-term creditors are interested in ascertaining liquidity ratios for timely payment of their debts.

Liquidity ratio includes:

Current Ratio: It explains the relationship between current assets and current

liabilities. It is calculated as:

Current Ratio = Current Assets/Current Liabilities

Liquid Ratio or Quick Ratio: It explains the relationship between liquid assets and current liabilities. It indicates whether a firm has sufficient funds to pay its current liabilities immediately. It is calculated as:

Liquid Ratio = Liquid Asset/Current LiabilitiesLiquid

Liquids Assets = Current Assets – Stock – Prepaid Expenses.

The solvency position of any firm is determined and measured with the help

of solvency ratios. In this way we can say that the ratios which throw light on the

debt servicing ability of the businesses in the long run are known as solvency

ratios. Solvency of a concern can be measured in two ways first to check the

security of Debt and second is to check the security of return on Debt. For

calculating the security of debt we calculate Debt-Equity Ratio, Proprietory Ratio,

Fixed Assets – Proprietory Fund Ratio, etc. And for calculating Security of Return on Debt we calculate Interest Coverage Ratio.

A brief description of the above mentioned ratios is as follows Debt Equity

Ratio :

Debt Equity Ratio: indicates the relationship between the external equities or

outsiders funds and the internal equities or shareholders funds. It is also known as external internal equity ratio. It is determined to ascertain soundness of the long term financial policies of the company.

Debt Equity Ratio = External Equities

Shareholders Funds

Proprietory Ratio/ Total Assets to Debt Ratio: Total assets to Debt Ratio or

Proprietory Ratio are a variant of the debt equity ratio. It is also known as equity

ratio or net worth to total assets ratio. This ratio relates the shareholder’s funds

to total assets. Proprietory/Equity Ratio indicates the long-term or future solvency position of the business. Formula of Proprietary/Equity Ratio

Proprietory or Equity Ratio = Shareholders Funds

Total Assets

Shareholder’s funds include equity share capital plus all reserves and surpluses

items. Total assets include all assets, including Goodwill. Some authors exclude

goodwill from total assets. In that case the total shareholder’s funds are to bedivided by total tangible assets. The total liabilities may also be used as the

denominator in the above formula.

Fixed Assets to Proprietor’s Fund Ratio: Fixed Assets to Proprietor’s Fund Ratio

establish a relationship between fixed assets and shareholders’ funds. The

purpose of this ratio is to indicate the percentage of the owner’s funds invested fixed assets. The formula for calculating this ratio is as follows The fixed assets are considered at their book value and the proprietor’s funds consist of the same

items as internal equities in the case of debt equity ratio.

Fixed Assets to Proprietors Fund = Fixed Assets

Proprietors Fund

Interest Coverage Ratio :This ratio deals only with servicing of return on loan as

interest. This ratio depicts the relationship between amount of profit utilise for

paying interest and amount of interest payable. A high Interest Coverage Ratio

implies that the company can easily meet all its interest obligations out of its

profit.

Interest Coverage Ratio = Net Profit before Interest and Tax

Interest on Long Term Loans

Profitability Ratios Profitability ratios measure the results of business operations or overall performance and effectiveness of the firm. Some of the most Important and popular profitability ratios are as under

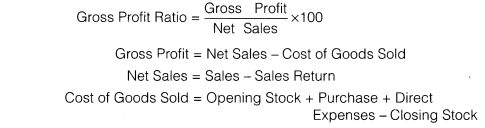

Gross Profit Ratio: Gross Profit Ratio (GP ratio) is the ratio of gross profit to net sales expressed as a percentage. It expresses the relationship between gross profit and sales. The basic components for the calculation of gross profit ratio are gross profit and net sales. Net sales mean sales minus sales returns.

Gross profit would be the difference between net sales and cost of goods sold. Cost of goods sold in the case of a trading concern would be equal to opening stock plus purchase, minus closing stock plus all direct expenses relating to purchases. In the case of manufacturing concern, it would be equal to the sum of the cost of raw materials, wages, direct expenses and all manufacturing expenses. In other words, generally the expenses charged to profit and loss account or operating expenses are excluded from the calculation of cost of goods sold.

Following formula is used to calculate gross profit ratios

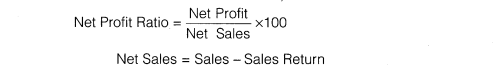

Net Profit Ratio :Net Profit Ratio is the ratio of net profit to net sales. It is expressed as percentage. The two basic components of the net profit ratio are the net profit and sales. The net profits are obtained after deducting income-tax and, generally, non-operating expenses and incomes are excluded from the net profits for calculating this ratio. Thus, incomes such as interest on investments outside the business, profit on sales of fixed assets and losses on sales of fixed assets, etc are excluded.

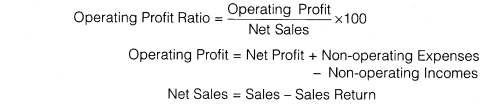

Operating Profit Ratio :Operating Profit Ratio is the ratio of operating profit to net sales. There are many non operating expenses and incomes included in the profit and loss account which has nothing to do with the operations of the business such as loss by fire, loss by theft etc. On the other had in credit side of the P&L account, there are so many incomes

which can be considered as operating incomes such as dividend, bank interest, rent etc. In this way net profit ratio will not tell the truth about the profit of the organisation. Hence operating profit ratio will be helpful in that case. The formula for calculating operating ratio is as follows

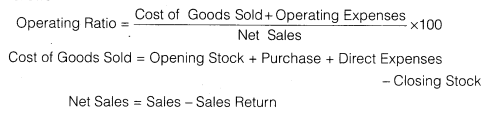

Operating Ratio :Operating ratio is the ratio of cost of goods sold plus operating expenses to net sales. It is generally expressed in percentage, Operating ratio measures the cost of operations per dollar of sales. This is closely related to the ratio of operating profit to net sales. The two basic components for the calculation of operating ratio are operating cost (cost of goods sold plus operating expenses) and net sales. Operating expenses normally include (a) administrative and office expenses and (b) selling and distribution expenses. The formula for calculating the operating ratio is as follows

The above mentioned statement is true. There are two different ways to measure the liquidity of a firm first through current ratio of the firm and second through quick ratio of the firm. The second one is considered the more refine form of measuring the liquidity of the firm. The current ratio ‘explains the relationship between current assets and current liabilities. If current assets are quite capable to pay the current liability the liquidity of the concerned firm will be considered good. But here generally one question arises there are certain assets which cannot be converted into cash quickly such as stock and prepaid expenses. As far as the matter of prepaid expenses is concerned it’s ok but what about the stock if we measure the liquidity on the basis of conversion of current assets in cash there are many firms where conversion of stock is not possible into cash frequently say e.g., heavy machinery manufacturing companies, locomotive companies, etc. This is because, the heavy stocks like machinery, heavy tools etc. cannot be easily sold off. In this case it is always advisable to follow the current ratio for measuring the liquidity of a firm. But on the other hand, in case of those firms where the stock can be easily realised or sold off consideration of stock should be avoided and to measure the liquidity of that firm Quick ratio should be calculated, e.g., the inventories of a service sector company are very liquid as there are no stocks kept for sale, so in that case liquid ratio must be followed for measuring the liquidity of the firm. We can understand from the above mentioned statement in the light of another example where stock contribute the major portion in current assets in that case to find out the liquidity of that firm stock cannot be avoided to measure the liquidity of the firm. On the other hand where stock contributes a reasonably less amount it can be avoided and liquidity of that firm can be measured with the help of quick ratio. On the other hand where there is a lot of fluctuation in the price of stock it is always advisable to compute quick ratio and avoid the stock figure because it will reduce the authenticity of liquidity measure.

Join thousands of students who have improved their academic performance with our comprehensive study resources.