Complete NCERT Solutions Guide

Access step-by-step solutions for all NCERT textbook questions

Welcome to the Chapter 5 - Dissolution of a Partnership Firm, Class 12 Accountancy NCERT Solutions page. Here, we provide detailed question answers for Chapter 5 - Dissolution of a Partnership Firm. The page is designed to help students gain a thorough understanding of the concepts related to natural resources, their classification, and sustainable development.

Our solutions explain each answer in a simple and comprehensive way, making it easier for students to grasp key topics Dissolution of a Partnership Firm and excel in their exams. By going through these Dissolution of a Partnership Firm question answers, you can strengthen your foundation and improve your performance in Class 12 Accountancy. Whether you’re revising or preparing for tests, this chapter-wise guide will serve as an invaluable resource.

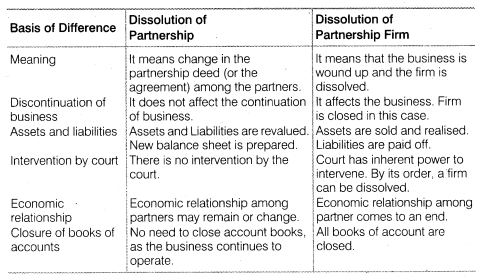

The difference between the Dissolution’ of Partnership and Dissolution of Partnership Firm is as follows.

(i) Accounting Treatment for Unrecorded Assets Unrecorded asset is an asset, which have not been shown in the books of account or which has been written off in the books of accounts, but the asset is still available in physical condition. Sometimes it is sold outside for cash and sometimes it is taken away by the partner. The accounting treatment for unrecorded asset will be there according

to the situation.

(a) When the unrecorded asset is sold for cash the following Journal Entry will be there:

Cash A/c. Dr.

To Realisation A/c

(Being unrecorded assets sold for cash)

(b) When the unrecorded asset is taken over by any partner the following Journal Entry will be there:

Partners Capital A/c Dr.

To Realisation A/c

(Being unrecorded assets taken over by the partner)

(ii) Accounting Treatment for Unrecorded Liabilities Unrecorded liabilities are

those liabilities, which have not been shown in the books of account. But at the time of dissolution they are required to be paid off. The following Journal Entry will be there as per situation.

(a) When the unrecorded liability is paid off the following Journal Entry will be there:

Realisation A/c. Dr.

To Cash A/c

(Being unrecorded liability paid in cash)

(b) When the unrecorded liability is taken over by a partner. The following

Journal Entry will be there:

Realisation A/c. Dr.

To Partners Capital A/c

(Being unrecorded liability taken over by the partner)

(a) When loan amount is shown in the assets side of the balance sheet, it

indicate that the loan has been granted by the firm to the partner. In that case, at the time of dissolution the amount of loan will be transferred to the concerned

partner’s capital account. The following Journal Entry will be passed:

Partners Capital A/c. Dr.

To Partners Loan A/c

(Being partners loan amount is transferred to partners capital account)

(b) When the amount of loan appears in the liabilities side of the balance sheet, it indicate that the respective partner or partners have given loan to the firm. In this case, partner’s loan will be paid off after paying all the external liabilities first.

Here, it is worth mentioning that the partner’s loan will not be transferred to the

realisation account, in fact, it will be paid in cash. The following accounting entry will be passed in this regard:

Partners Loan A/c. Dr.

To Cash/Bank A/c

(Being loan taken from partner is paid in cash)

OUR EXPERTS WILL GIVE THE ANSWER SOON

OUR EXPERTS WILL GIVE THE ANSWER SOON

OUR EXPERTS WILL GIVE THE ANSWER SOON

Dissolution means breaking of relationship among the partners. As per Section 39 of the Indian Partnership Act 1932 the dissolution of firm implies that not only partnership is dissolved but the firm losses its existence i.e. after dissolution the firm does not remain in business. Dissolution of partnership firm implies discontinuation of the business of the partnership firm. Dissolution involves winding up of business disposal of assets and paying off the liabilities and distribution of any surplus or borne of loss by the partners of the firm. As per thePartnership Act 1932 a partnership firm may be dissolved in the following manners.

i) Dissolution by Agreement: As a firm is formed with the consent of all partners with a mutual agreement. Dissolution can also be there with the help of agreement. It happens in following two ways. A firm may be dissolved a When all the partners 10 agree to dissolve the firm. b When there is any term related to dissolution of firm in the partnership agreement.

ii) Compulsory Dissolution: A firm may be dissolved compulsorily in the following condition a In case all the partners or all except one partner become insolvent or insane. b If the business becomes illegal. c Where all the partners except one decide to retire from the firm. d Where all the partners except one die.

iii) Dissolution by Notice: When partnership is at will then the partnership firm

may be dissolved if any partner give notice in writing to all the other partners expressing his/her intention to dissolve the firm.

iv) Dissolution by Court: A court may order for dissolution if a suit is filed by a

partner as per Section 44 of Indian Partnership Act 1932. The court may order to

dissolve a partnership in following conditions:

a) A partner becomes insane.

b) A partner commits breach of agreement wilfully.

c) When a partner’s conduct affects the business.

d) When a partner transfers his interest to a third party.

e) If business cannot be continued.

f) If a partner becomes incapable of doing business.

g) If court thinks dissolution to be just and equitable on any ground. Besides these above mentioned circumstances a partnership firm may be dissolved if the court at any stage finds dissolution of the firm to be justified and inevitable.

Realization Account is prepared at the time of dissolution of a partnership

firm. This account is prepared to know the profit made or loss incurred at the time of dissolution of a firm. All the assets except cash and bank a/c are transferred to the debit side of realization account and liabilities (not capital accounts) are transferred to the credit side of realization account. When assets are sold 11

cash/bank A/c is debited and Realization A/c credited. On settling the liabilities

Realization A/c is debited and Cash/Bank A/c is credited. In last if total of credit

side exceeds debit side, it means there is profit and that is transferred to partners capital accounts. In case of loss, the partners' capital accounts are debited and Realization A/c credited.

OUR EXPERT WILL GIVE THE ANSWER SOON

For settlement with the creditor through transfer of assets when a creditor

accepts an asset in full and final settlement of his account, journal entry needs to be recorded. But, if the creditor accepts an asset only as part payment of his/her dues, the entry will be made for cash payment only. For example, a creditor to whom Rs. 10,000 was due accepts office equipment worth Rs 8,000 and is paid Rs. 2,000 in cash, the following entry shall be made for the payment of Rs. 2,000 only.

Realisation A/c Dr.

To Bank A/c

However, when a creditor accepts an asset whose value is more than the amount due to him, he/she will pay cash to the frim for the difference for which the entry will be:

Bank A/c Dr

To Realisation A/c

(For payment of realisation expenses )

(a) When some expenses are incurred and paid by the firm in the process of

realisation of assets and payment of liabilities: 12

Realisation A/c. Dr.

To Bank A/c

Join thousands of students who have improved their academic performance with our comprehensive study resources.