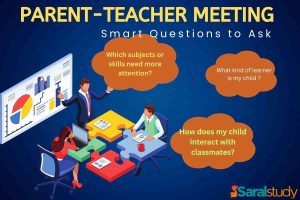

Smart Questions to Ask in a Parent-Teacher Meeting | PTM Made Easy

Parent-Teacher Meetings (PTMs) are more than quick updates on marks — they’re a chance to build a real partnership between home and school. A good Parent-Teacher Meeting conversation helps parents see beyond grades. It opens up insights about a child’s strengths, struggles, emotions and even hidden talents. When parents participate actively, they don’t just track […]

Read More

Student Discussion

Be the first to comment.

ADD NEW COMMENT